The medical aid industry continues to face tough headwinds: affordability challenges, stagnant membership, ageing populations, anti-selection, and medical inflation that continues to outpace CPI.

Increases alone don’t tell the full story. What matters just as much are the benefit changes we’re making for 2026. And here, our guiding principle was clear: you asked, and we listened.

BENEFIT CHANGES FOR 2026

Maternity benefit enhancements to flexiFED 1

First up is the enhancement of out-of-hospital maternity benefits on flexiFED 1 to now include two 2D scans, six ante- or postnatal consults, an amniocentesis and funding for antenatal classes. Enhancements that will make one of our fastest growing options even more competitive, especially when you take its low 5% increase for 2026 into account!

Mental health benefits on flexiFEDSavvy, flexiFED 1 and 2

In 2026, mental health support will be taken to a different level. Until now, funded access to depression medication has been available only on flexiFED 3 and higher. From next year, we will be extending this crucial benefit to members on the lower-range options as well.

- On flexiFEDSavvy, members will have an annual limit of R2 160 per beneficiary for out-of-hospital depression medication.

- On flexiFED 1 and 2, the limit will be R2 400 per beneficiary. This means that our fastest-growing, most affordable options offer even more meaningful support for

mental health – something that matters deeply to younger members and makes these plans even more attractive.

Additional benefit enhancements

- In 2026, our female contraception paid from the Risk benefit will also include cover for emergency contraception on all options.

- We’re enhancing our preventative and wellness benefits for older members by adding an additional pneumococcal vaccine for all lives aged 65 and older.

- We are further enhancing our already generous oncology benefits by increasing the Brachytherapy benefit limit on flexiFED 4 by a massive 25% to provide greater peace of mind to oncology patients.

- We have also applied inflationary adjustments across all benefit limits to keep pace with rising costs.

- Alongside these enhancements, we’ve implemented targeted cost-containment measures on certain entry-level options to protect long-term affordability.

NEW! D2D+ benefit

By completing a Health Risk Assessment and downloading the Fedhealth Member App, members on flexiFED 1, 2, 3 and 4 will activate our new D2D+ benefit and unlock up to R4 500 in additional day-to-day benefits per family for GP and specialist consultations, prescribed medication, basic dentistry, pathology and general radiology. Claims paid from the D2D+ benefit won’t accumulate to Threshold.

This new benefit will bring even more day-to-day value for members!

NEW! Switching to a PAC Savings structure on flexiFED options in 2026

On Fedhealth, Savings allocations have always been calculated on a ‘Member Plus’ or ‘M+’ basis. For example, a family unit of a father and son received the same Savings allocation as a family unit of a husband and wife. But from 2026, we’ll use a market-aligned PAC structure: a set allocation per Principal Member, Adult Dependant and Child Dependant. This makes Savings fairer, reflecting your clients’ actual family composition and linking directly to each beneficiary’s contribution. It also makes our Savings plans easier to compare across the market.

This might have an impact on your clients’ contribution, but overall, members will have more Savings available.

- In addition to the PAC restructure, we’ve increased Savings levels on average. These enhanced Savings levels will strengthen flexiFED’s competitiveness and better meet our members’ needs.

- We’ve removed the self-payment gaps on flexiFED 1, 2 and 3. This means that from 2026, once these members deplete their fixed Savings, the Scheme will continue to pay for unlimited GP consultations as well as the relevant dental benefits.

ONE OF THE LOWEST INCREASES IN YEARS!

Since the start of 2024, everything has been moving in a positive direction for the Scheme. The partnership with Sanlam has played a big role, with all Sanlam staff coming on board, as well as new corporate group clients joining us. This has strengthened Fedhealth’s risk profile and grown our membership base. The Scheme is on a strong upward trajectory, performing better than ever.

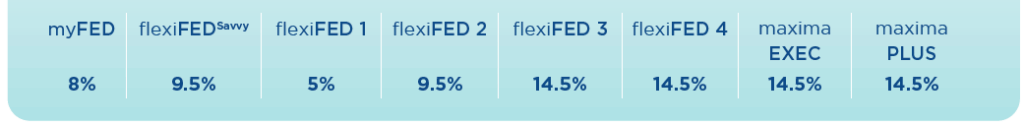

Our average weighted increase for 2026 is just 9.6%!

- myFED in 2026 will maintain its competitive edge with an increase of just 8%, while still offering an exceptional level of cover for low-income earners, such as miners.

- flexiFED Savvy will see a 9.5% increase, which still translates to an increase of only R100 per month for a main member. Created specifically for the underserved, under-35, digitally savvy audience, flexiFED Savvy is our fastest-growing option, with a great risk profile. This increase is proof that we affordable medical aid

option. - Members on flexiFED 1, our other fastest-growing option, will only pay 5% more next year – that’s R125 per month for a main member. flexiFED 1 is especially popular among younger, healthier members who are progressing in their careers but are well beyond just starting out. By attracting more people who fit this profile, our overall risk pool becomes even stronger. This is also part of our effort to support you. You asked us to make flexiFED 1 as competitive as possible – and we did!

In conclusion

To summarise, we’ve announced our lowest weighted increase in years at just 9.6% overall, and just 5% on our fastest growing option, flexiFED 1. We are enhancing benefits where they matter most, and where you’ve asked us to, and have introduced D2D+, which repays smart health choices with up to R4,500 in additional day-to-day benefits. This is a foundation built to last – and Built Different, giving our brokers and members confidence for the future.